Trump’s energy secretary seeks to curb climate-conscious retirement investing

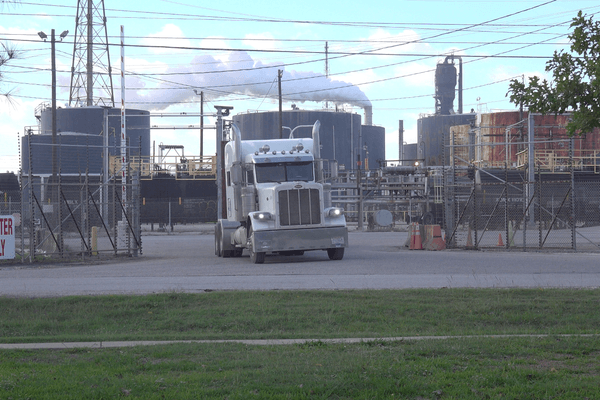

Chris Wright, the new U.S. energy secretary and former fracking CEO, has been pushing to weaken rules that allow retirement fund managers to consider environmental, social, and governance (ESG) factors when investing.

Sasha Chavkin reports for The Examination in partnership with Grist.

In short:

- Wright led a legal effort to overturn a Labor Department rule permitting ESG considerations in managing 401(k) plans, but a federal judge dismissed the case in February.

- The fossil fuel industry and conservative groups are campaigning against ESG investing, arguing it prioritizes politics over retirees' financial interests.

- Major banks, including BlackRock and JPMorgan Chase, have recently distanced themselves from ESG commitments amid political and legal pressure.

Key quote:

“This is the exact opposite of free-market ideology.”

— Lisa Sachs, director of the Center on Sustainable Investment at Columbia University

Why this matters:

Advocates argue that incorporating ESG factors helps investors manage risks, particularly those linked to extreme weather, shifting regulations, and the long-term viability of industries like real estate and energy. Without these considerations, they warn, financial instability could grow as markets fail to account for mounting climate-related costs.

Yet, ESG has also become a political lightning rod. Critics, including some Republican-led states and fossil fuel interests, contend that ESG investing injects progressive ideology into financial decision-making. Moves to restrict ESG considerations, including state-level bans and congressional efforts, have gained traction, with opponents arguing that investment decisions should be based solely on financial performance rather than broader societal concerns.

Learn more: How to shift to environmentally conscious investments