Trump administration weighs keeping carbon capture tax credit backed by oil industry

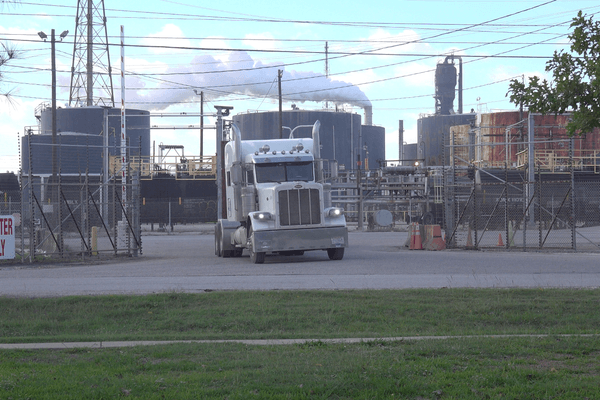

The Biden-era tax credit for carbon capture, a policy long supported by the oil industry, could survive under Trump, despite his administration’s broader rollback of climate policies.

Zoë Schlanger reports for The Atlantic.

In short:

- The 45Q tax credit, part of former President Biden’s Inflation Reduction Act, offers financial incentives for companies to capture and store carbon dioxide, a measure supported by both the oil industry and some Democrats.

- Critics argue that the credit primarily benefits fossil fuel companies, as most captured carbon is used to extract more oil rather than permanently stored underground.

- Landowners and environmental groups oppose new carbon pipelines required for storage, citing safety risks and concerns over eminent domain seizures.

Key quote:

“In my mind, this is a company that stands to make a lot of money from this project, which I believe is just a grift on the taxpayers.”

— Karla Lems, South Dakota Republican state representative

Why this matters:

Carbon capture has been promoted as a tool to combat climate change, but its real-world impact is debated. While supporters say it reduces emissions, most captured carbon is used for oil production, raising questions about its climate benefits. The 45Q tax credit plays a crucial role in expanding this technology, but concerns over land use, safety, and government spending have turned it into a political battleground. The future of the policy could shape both U.S. energy production and climate efforts.

Read more: Carbon capture technology faces cost and scale challenges