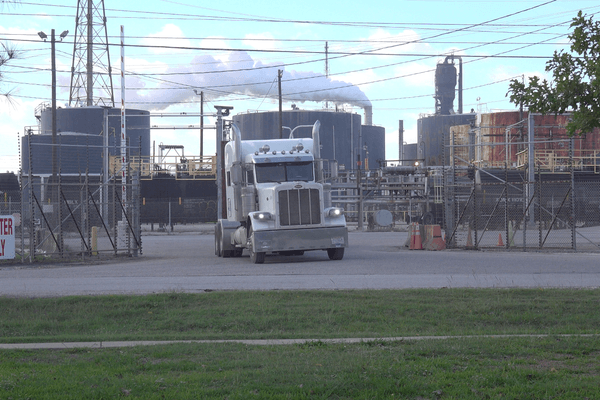

Tax breaks for LNG terminals leave Gulf Coast communities shortchanged

Gulf Coast communities in Texas and Louisiana lose critical tax revenue due to lucrative agreements granting tax breaks to liquefied natural gas developers, according to a Sierra Club report.

Dylan Baddour reports for Inside Climate News.

In short:

- LNG developers in Texas and Louisiana benefit from extensive tax breaks, saving billions while communities face revenue shortfalls for schools and infrastructure.

- A Texas program, now expired, allowed school districts to grant long-term tax abatements, with some agreements running into the 2040s.

- Critics argue that promised job creation rarely offsets the public costs, and nearby communities often see little of the economic growth.

Key quote:

“The oil and gas industry severely short changes communities of color like mine with promises of jobs and opportunities.”

— John Beard, former city council member in Port Arthur and founder of the Port Arthur Community Action Network

Why this matters:

Tax abatements intended to attract industrial investment often leave local governments underfunded, particularly in regions already grappling with poverty and unemployment. Without critical revenue, communities risk falling further behind in providing essential services.

Related EHN coverage: LNG production comes with a price, Gulf Coast communities warn