tariffs

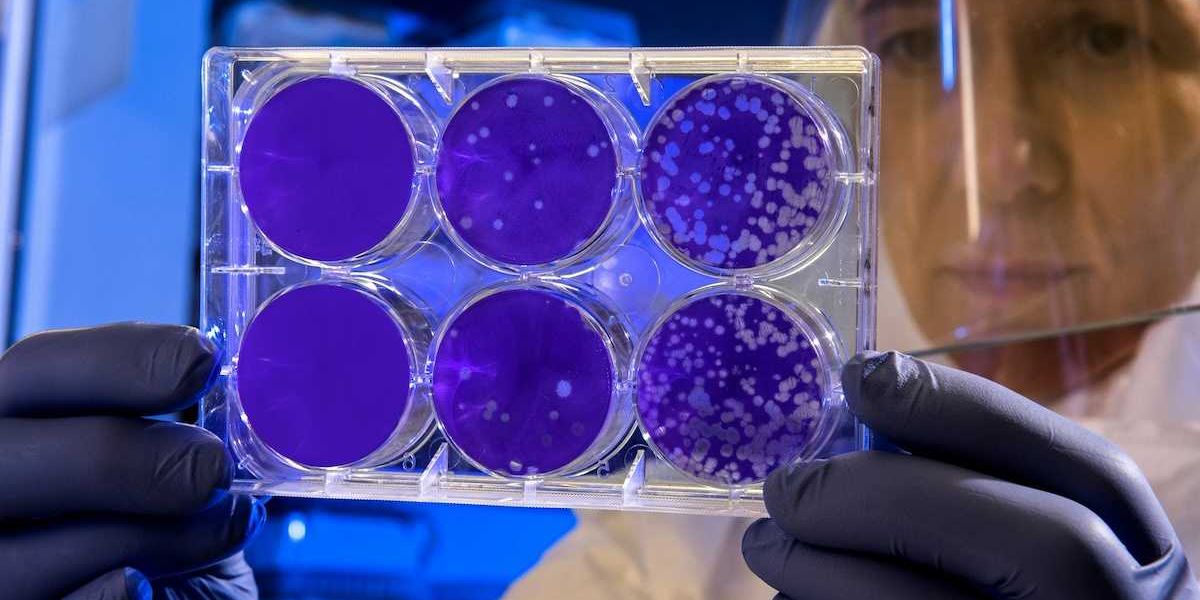

US-China trade tensions hit Southeast Asia’s solar industry, impact EU

US tariffs on Southeast Asian solar panel exports may disrupt Chinese-owned solar companies in the region, complicating the EU’s solar expansion efforts.

In short:

- Southeast Asian solar producers face rising US tariffs, which could reduce solar panel exports to the US.

- Chinese solar firms in the region have scaled back operations, affecting the EU’s solar manufacturing ambitions.

- Some manufacturers are shifting production to other Southeast Asian nations not currently facing tariffs, like Indonesia and Laos.

Key quote:

"Southeast Asian solar panels could flood the EU market as they are squeezed out of the US."

— Indra Overland, head of the Norwegian Institute of International Affairs' Center for Energy Research

Why this matters:

US tariffs could undermine the EU's solar industry by increasing competition from Southeast Asia. These shifts may also reshape global solar supply chains, influencing renewable energy access worldwide.

Related: American solar firms request federal action against Asian competitors

Canada imposes new tariffs on Chinese-made electric vehicles

Canada is enacting a 100% tariff on Chinese-made electric vehicles, mirroring U.S. actions taken due to China's alleged market-distorting subsidies.

In short:

- Canada announced the tariffs after discussions with U.S. national security advisor Jake Sullivan.

- Canada will also impose tariffs on Chinese steel and aluminum and may consider more tariffs on other goods.

- China condemned the tariffs as protectionist, warning of potential retaliatory actions.

Key quote:

“Actors like China have chosen to give themselves an unfair advantage in the global marketplace.”

— Justin Trudeau, Canadian Prime Minister

Why this matters:

These tariffs could escalate trade tensions between China, Canada and the U.S., impacting global markets and the electric vehicle industry. The dispute highlights ongoing concerns about China's influence on global trade.

Related:

China and the EU discuss potential tariff hikes on Chinese electric vehicles

China and the European Union are considering negotiations over the EU's decision to significantly increase tariffs on Chinese-made electric vehicles.

In short:

- The EU plans to impose provisional tariffs of 17.4% to 38.1% on Chinese-made EVs starting July 4, citing unfair subsidies that harm EU automakers.

- Both China and Germany's economy minister expressed willingness to hold discussions to resolve the dispute before the tariffs take effect.

- China is also investigating European pork imports, which may be a response to the EU's EV tariff measures.

Key quote:

“The doors are open for discussions. And I hope that this message was heard.”

— Robert Habeck, Germany’s economy minister and vice chancellor

Why this matters:

Increased tariffs could escalate trade tensions between China and the EU, impacting global trade and the electric vehicle market. An agreement could help avoid further economic conflict and support fair competition in the automotive industry.

US imposes tariffs on Chinese electric vehicles to protect domestic industry

President Joe Biden's administration has increased tariffs on Chinese electric vehicles, a move supported by U.S. automakers to shield local jobs and investments from low-cost imports.

In short:

- The Biden administration raised the tariff on Chinese electric vehicles to 100%, aiming to support U.S. electric vehicle and battery production.

- This tariff strategy reflects concerns about China's potential to flood the U.S. market with economically priced electric vehicles, challenging domestic manufacturers.

- U.S. automakers argue that such protective measures are vital for maintaining competitiveness and safeguarding American jobs.

Key quote:

"Today’s announcement is a necessary response to combat the Chinese government’s unfair trade practices that endanger the future of our auto industry."

— Senator Gary Peters, Michigan Democrat

Why this matters:

The move underscores growing unease over China's rapid advancements in the electric vehicle sector, which pose significant competition to U.S. manufacturers. By imposing these tariffs, the U.S. aims to prevent market saturation with cheaper imports, thereby encouraging local production and technological innovation in the burgeoning electric vehicle industry.

New tariffs on Chinese goods by the Biden administration amidst campaign tensions

Amidst election-year campaigning, the Biden administration introduces new tariffs targeting Chinese electric vehicles and other key products.

Josh Boak, Fatima Hussein, Paul Wiseman, and Didi Tang report for The Associated Press.

In short:

- The tariffs will impact electric vehicles, advanced batteries, solar cells, steel, aluminum, and medical equipment over the next three years.

- Officials claim the tariffs aim to curb the influence of subsidized Chinese goods in U.S. markets, though their impact on inflation is expected to be minimal.

- Despite administration claims of minimal escalation, China warns of potential retaliatory measures and critiques U.S. protectionism.

Key quote:

“China’s factory-led recovery and weak consumption growth, which are translating into excess capacity and an aggressive search for foreign markets, in tandem with the looming U.S. election season add up to a perfect recipe for escalating U.S. trade fractions with China."

- Eswar Prasad, professor of trade policy at Cornell University

Why this matters:

These tariffs represent a strategic attempt by the U.S. to strengthen its manufacturing sector and reduce dependency on Chinese imports. The move has drawn immediate reactions from various sectors. Economists are debating the potential for these tariffs to ignite a trade war, which could disrupt global supply chains and increase prices for American consumers. From an environmental standpoint, the tariffs on EVs seem counterintuitive to global efforts aimed at reducing carbon emissions.

American solar firms request federal action against Asian competitors

American solar manufacturers are calling for the U.S. government to impose measures against Asian countries allegedly dumping subsidized panels into the market, arguing this threatens the domestic industry.

In short:

- U.S. manufacturers argue that solar panels subsidized by China, but manufactured in other Asian countries, are damaging the U.S. market.

- The petition targets imports from Cambodia, Malaysia, Vietnam and Thailand, which represent 84% of U.S. solar panel imports in the last quarter of 2023.

- The controversy stirs debate within the solar sector, with some warning that tariffs could disrupt growth and escalate costs for consumers.

- China responded that their leading place in the global solar panel market is attributable to "strong performance and full-on market competition, nut subsidies."

Key quote:

"We are seeking to enforce the rules, remedy the injury to our domestic solar industry and signal that the U.S. will not be a dumping ground for foreign solar products."

— Tim Brightbill, attorney for the American Alliance for Solar Manufacturing Trade Committee, the group that filed the petition.

Why this matters:

American firms often argue that Chinese and other Asian manufacturers benefit from significant government subsidies, lower labor costs and less stringent regulations. This can result in lower production costs and cheaper products, making it difficult for American manufacturers to compete on price.

Be sure to listen to Agents of Change senior fellow Azmal Hossan as he talks about an ambitious effort he’s part of to get the U.S. and China working together on climate change.

Visit EHN's energy section for more top news about energy, climate and health.

Oil industry's mixed feelings on Trump's potential return

In Houston, oil and gas executives express their reservations about both the current and former presidents, showcasing a complex political landscape for the fossil fuel industry.

In short:

- Executives criticize Biden's regulatory measures but fear Trump's return could reintroduce trade tensions and unpredictability.

- While appreciating Trump's support for U.S. fossil fuel energy, concerns linger about his trade policies potentially harming the industry.

- The sector, leaning Republican, is caught in a dilemma, weighing policy benefits against economic stability risks.

Key quote:

"Trump is going to be Trump. I expect he’ll pick up where he left off if he’s reelected.”

— Dan Eberhart, CEO of oilfield services company Canary

Why this matters:

The energy industry's response to a potential second Trump presidency involves anticipation of policies that could significantly reshape U.S. energy production, particularly in favor of fossil fuels. Experts and analysts suggest that under a Trump administration, there would likely be a concerted effort to undo much of the Biden administration’s climate change mitigation efforts and to boost fossil fuel production.

Have market pressures changed since Trump was president? In this 2019 piece, Douglas Fischer wrote: As Trump retreats, financial markets push for sustainability, climate accountability.