Report proposes fossil fuel tax to fund climate crisis aid

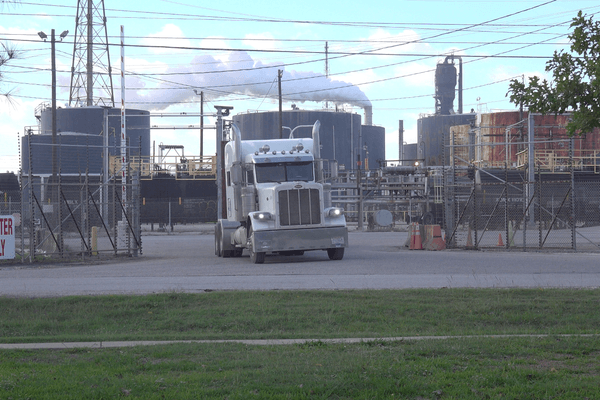

A proposed tax on fossil fuel companies in wealthy nations could generate substantial funds to support countries hardest hit by climate change, a recent report suggests.

Matthew Taylor reports for The Guardian.

In short:

- The Climate Damages Tax, aimed at fossil fuel majors in OECD countries, is expected to collect $720 billion by 2030 for a global loss and damage fund.

- Proposed rates start at $5 per ton of CO2 equivalent, increasing annually, with potential to raise $900 billion in total.

- The tax is endorsed by several climate groups and aims to facilitate a fair transition away from fossil fuels.

Key quote:

“Extreme weather is claiming lives and causing catastrophic damage around the world. But while communities that have contributed least to the crisis find themselves on its frontlines, and households across Europe struggle with sky-high energy bills, the fossil fuel industry continues to rake in massive profits with no accountability for its historic and ongoing impact on our climate.”

— Areeba Hamid, joint director at Greenpeace UK

Why this matters:

The proposed tax on fossil fuel companies stands not only as a fiscal measure but as a moral statement, recognizing that while the benefits of fossil fuels have been largely enjoyed by the wealthier nations, the repercussions — erratic weather patterns, rising sea levels, and severe natural disasters — have disproportionately burdened the poorest.