22 October

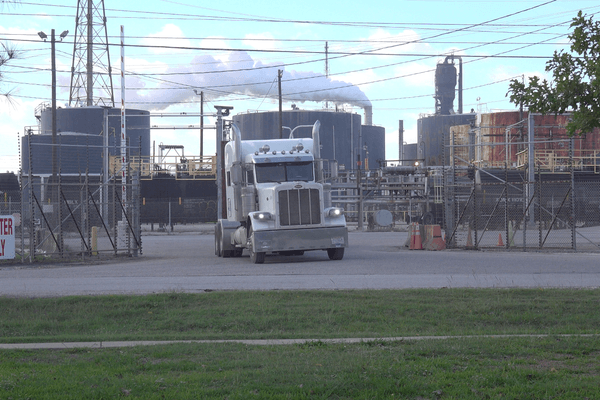

Middle East conflict no longer triggers spikes in oil prices

Escalating conflict between Israel, Iran and Hezbollah hasn’t led to a significant increase in oil prices, as global energy markets have become less reliant on Middle Eastern oil.

James Surowiecki writes for The Atlantic.

In short:

- U.S. oil production has surged due to fracking, making the country less dependent on foreign oil, especially from the Middle East.

- OPEC+ has spare capacity, enabling it to offset potential supply disruptions from countries like Iran.

- Shifts to renewables and lower oil demand, particularly from China, have dampened price volatility in response to geopolitical events.

Key quote:

“Resilience, in a sense, breeds resilience: Because traders are confident that the market will be able to deal with conflict, they’re more likely to assess risk in a coolheaded fashion, rather than a panicky one.”

— James Surowiecki, The Atlantic

Why this matters:

Global energy markets have become more adaptable to geopolitical crises, reducing their impact on oil prices. This shift reflects both the rise of U.S. oil production and increased diversification of energy sources.