Nippon Steel shareholders demand environmental accountability in light of pending U.S. Steel acquisition

“It’s a little ironic that they’re coming to the U.S. and buying a company facing all the same problems they’re facing in Japan.”

During a shareholders meeting in Tokyo last Friday, a group of investors in Nippon Steel asked the company to improve its decarbonization strategy and reduce harmful emissions in light of its pending acquisition of U.S. Steel.

Nippon Steel, the largest steel producer in Japan and the fourth-largest in the world, is set to purchase U.S. Steel pending regulatory approval by the US government. The sale is controversial because the United Steelworkers Union strongly opposes it, and has sparked an international political debate over whether U.S. Steel should remain “American owned.”

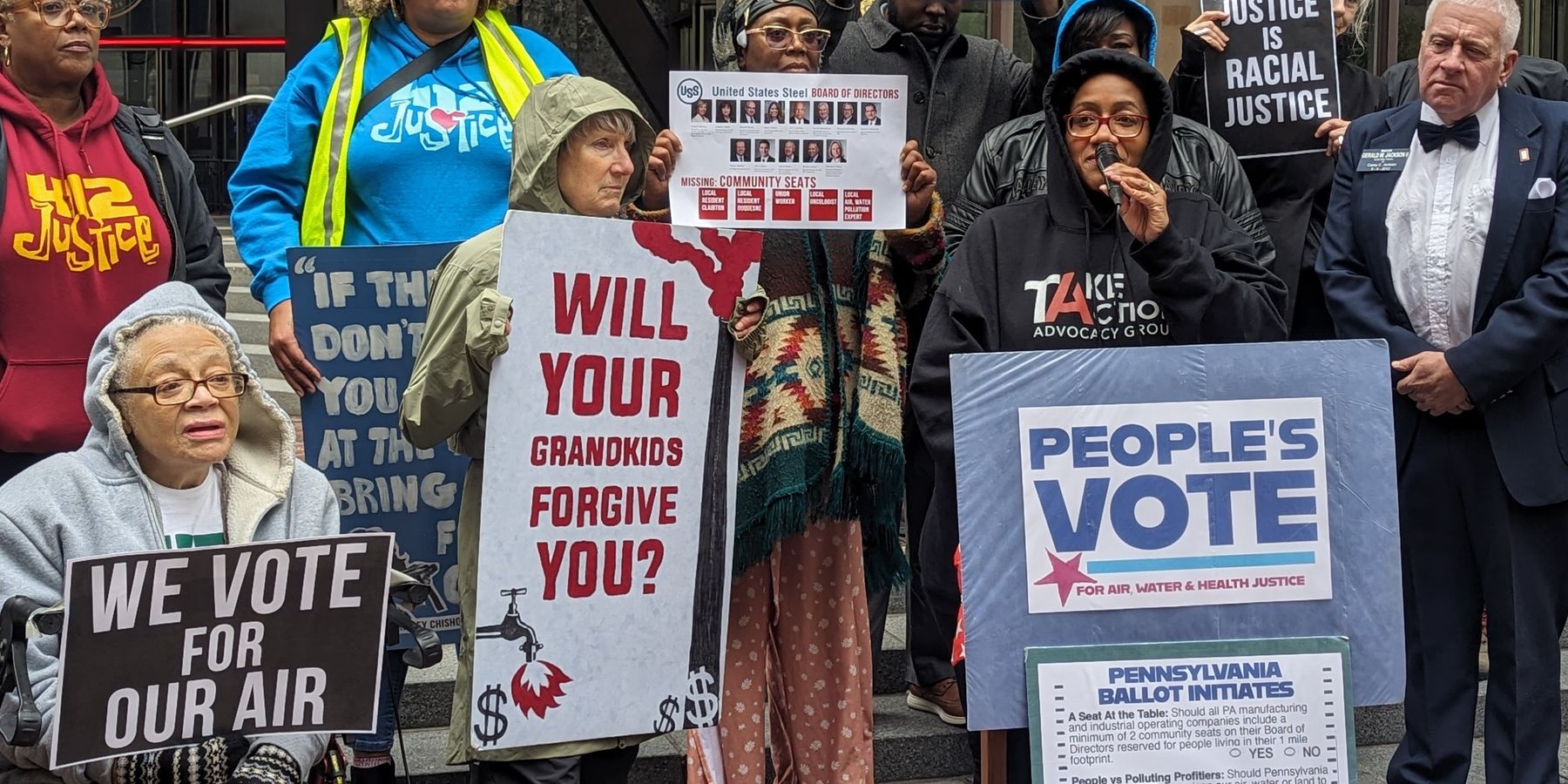

Meanwhile, experts say both Nippon Steel and U.S. Steel have fallen behind competitors when it comes to green steelmaking, and communities living near U.S. Steel’s polluting, coal-based manufacturing sites in places like western Pennsylvania say their concerns about health harms have been ignored in the debate about the sale.

A group of concerned investors say that Nippon Steel’s purchase of U.S. Steel, which still relies heavily on coal-based steel production at its 11 blast furnaces in the Pittsburgh region, is part of a pattern indicating the company has a “coal addiction.” Nippon Steel has also been buying up coal mines in other parts of the world, and recently started construction on two new blast furnaces in India.

“Steel does not have a climate problem, it has a coal problem,” Brynn O’Brien, executive director of the Australasian Centre for Corporate Responsibility, one of the investment groups calling for changes at Nippon Steel, told EHN. “Shareholders should note neither U.S. Steel nor Nippon Steel have Paris-aligned targets, and the potential addition of U.S. Steel’s 11 blast furnaces to Nippon Steel’s operations will place more pressure on the company to demonstrate to shareholders it has a credible decarbonization strategy.”

O’Brien’s organization, along with the investment groups Corporate Action Japan and Legal & General Investment Management, filed three shareholder proposals ahead of last Friday’s meeting. The proposals asked Nippon Steel to set and disclose short and medium-term greenhouse gas emissions reduction targets aligned with the Paris Agreement, requested that executive profits be linked to the company’s emissions reduction targets (something other steel companies have already done) and asked for increased disclosure of climate-related lobbying activities.

When the proposals were presented at last Friday’s shareholder meeting, they were met with applause from other shareholders, according to people who were present.

“I think that’s a sign of the times that there’s increasing awareness that Nippon Steel has a climate problem it needs to get serious about, and that’s the message these investors sent,” Roger Smith, Asia lead for SteelWatch, an industry watchdog and climate advocacy group, told EHN.

The filing of the proposals came after a group of institutional investors collectively representing nearly $5 trillion of assets informally asked Nippon Steel for more environmental accountability last year, according to the Australasian Centre for Corporate Responsibility. The formal proposals were also supported by the large institutional investment firms Amundi, Nordea Asset Management and Storebrand Asset Management.

“Steel does not have a climate problem, it has a coal problem." — Brynn O’Brien, Australasian Centre for Corporate Responsibility

The proposals didn’t garner enough votes to be adopted at last Friday’s shareholder meeting, but about 21% of shareholders voted in support of the proposal to align emission goals with the Paris Agreement, 23% of shareholders voted in support of the proposal requesting that shareholder profits be linked to the company’s emission reduction targets and 28% of shareholders voted in favor of the proposal on improved disclosure of climate-related lobbying.

In Japan, climate-related shareholder proposals require a majority of two-thirds of the votes of the shareholders present in order to be adopted, according to O’Brien.

“Not meeting this threshold does not mean a company can or will disregard significant support for a proposal,” he said. “Given the significant shareholder support for all three proposals, we expect Nippon Steel to respond to this strong investor feedback… Good corporate governance requires, at a minimum, the company to analyze the reasons for the vote and consider how its strategy needs to evolve in line with investor expectations.”

Nippon Steel did not immediately respond to a request for comment on the shareholder proposals or its decarbonization strategy.

A competitive disadvantage

While the shareholders who filed the proposals raised climate and public health concerns, their primary concern was financial.

The support for the climate-related proposals at the shareholders meeting “is evidence that investors see a strong link between a credible decarbonization strategy and securing corporate value,” O’Brien said. “Continuing coal investment risks stranded assets, regulatory penalties and competitive disadvantages as global markets shift towards green steel production.”

The Paris Agreement has shifted the steel market dramatically, Smith said.

“It’s now the expectation of governments and steel buyers that low-emission steel will soon be available, and ultimately that will either be requested or required,” Smith said. “Some of Nippon Steel’s biggest rivals have plans to produce green steel in the next few years, but Nippon Steel has nothing to compete with that. They have no low-emissions primary steel, nor do they have any plans to produce it in the near future.”

O’Brien noted that while U.S. Steel’s Pennsylvania plants are problematic, Nippon Steel’s decarbonization strategy would benefit from acquiring the company’s electric arc furnace facilities in Alabama, which have a significantly lower carbon footprint and are necessary for the production of green steel.

“That doesn’t resolve shareholder concerns about making continued investments in coal-based facilities,” Smith said. “Investors need to know, is this just a dead end? Are you just going to run the blast furnaces into the ground and then walk away?”

The steel industry’s critical role in meeting global climate targets

“I don’t think they’re going to care about us," Natalie Morris, a resident of Braddock who lives near U.S. Steel’s Edgar Thomson Mill, told EHN during a protest last month over the sale to Nippon Steel.

Credit: Kristina Marusic for EHNSteel production is responsible for an estimated 7% of all human-made greenhouse gas emissions, and is the largest greenhouse gas emitter in the manufacturing sector. The steel industry’s carbon footprint impacts other major industries, including construction, transportation and energy production, so shrinking the industry’s emissions could also “substantially cut emissions for all those industries dependent on steel,” according to the World Economic Forum.

Both U.S. Steel and Nippon Steel have set goals of being carbon neutral by 2050, but both companies have been criticized for lacking concrete plans to reach that goal, for their continued reliance on coal when cleaner technologies are available and for that timeline being too slow to achieve the 1.5°C global warming limit established by the Paris Climate Agreement.

The MSCI Global Sustainability Index rates Nippon Steel’s projected emissions as being aligned with more than 3.2°C of global warming, indicating that the company’s “contribution to catastrophic climate change is higher than most.”

“It wouldn’t be a livable planet if every company did that,” Smith told EHN.

U.S. Steel doesn’t have an MSCI rating, but has been ranked “high risk” for investors concerned about sustainability by the investment research firm Morningstar.

“It’s a little ironic that Nippon Steel is coming to the U.S. and buying a company that’s facing all the same problems they’re facing in Japan,” Smith said.

The shareholders plan to continue applying pressure.

“There are further escalation tools available to shareholders, including voting on directors, if insufficient progress is made,” O’Brien said. “Investors want confidence that Nippon Steel is going to remain competitive into the future, and there is strong commitment to ensuring corporate value is secured.”