Car insurance costs surge as extreme weather increases risk

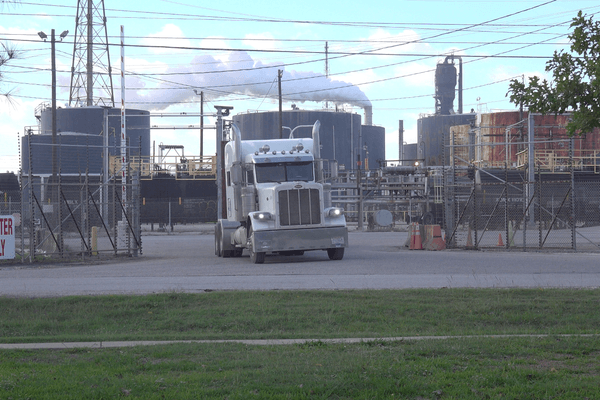

Auto insurance rates are rising across the U.S. as climate-driven events like hurricanes, wildfires and floods increasingly damage vehicles and strain insurance providers’ finances.

Kiley Price reports for Inside Climate News.

In short:

- U.S. car insurance rates could increase by up to 22% by year-end due to factors like extreme weather, inflation and increased accident rates.

- Secondary perils including flash floods and heavy rainstorms are causing significant vehicle damage, adding to the pressure on insurers to raise rates.

- Fraudulent sales of flood-damaged cars have risen, with scammers attempting to pass off these vehicles as undamaged to unsuspecting buyers.

Key quote:

“It’s actually secondary perils that are really having a dominant influence on driving up insurance costs.”

— Andrew Hoffman, professor of sustainable enterprise at the University of Michigan

Why this matters:

With car insurance costs on the rise, families may face higher financial burdens, especially as vehicle damage from extreme weather becomes more common. As insurers push premiums higher, flood-damaged vehicles entering the market could pose safety risks for buyers nationwide.

Related: Insurance woes increase as climate change impacts profitability